Project Feasibility Study

Before moving any project to the implementation stage, it is essential to study the feasibility of that project. Generally, it has to be performed once the business plan is ready for execution. Project Feasibility study will determine the factors which will make the business opportunity broader and clear. Today is the world of technology. There are numerous organizations which are involved in research and reports. The data is available of any product with proper analysis. We can use templates, surveys, and other social media tools to do the market survey.

It is vigorous to take this study at a comprehensive level as this report envisages a plan of future growth and success of the business. It should also evaluate the economic aspects and this should point out the cost-benefit analysis which would elude the projected financial data with the figured data comparison. With this data it is also intended to review that the legal requirements are exaggerated well and the operational feasibility of the demand and capacity of products meets in a justified time period? Ultimately this project evaluates the findings and the recommendation for our business appraisal.

Business Plan Preparation

A business plan is mandatory for any business projection with a specific mission, vision and objective. Business plan is a written document format with the organization’s core service or product describing before launching the business. Your business plan is a tool that will describe your project and will enhance to convince the investor with confidence. The investors or the lenders will brief the business plan before investing the fund in your organization. A business plan is a descriptive written article which includes Summary of the Organization , Financial projections, Product or Service Details, Market analysis, etc. A SWOT analysis should be performed which will implicate the future restitution and will act as an indicator of business growth. Elements like ROI, Funding request, Sales channel Distribution network, Digital marketing, Technical Expertise, etc should also be taken into consideration.

Customer Acquisition Strategy

Customer Acquisition Strategy is the process by which how you are going to acquire new customers will be emphasized. Ultimately any company’s final goal is to get sustainable and reliable customers who build trust in our product and are loyal to the company. Various tools are used to acquire new market segment and obtain reliable trustworthy consumers as under: There are various tactics which can be helpful to acquire new customers in the market. This marketing strategy helps to promote, enhance and grow the business in this cut throat competition era. Some of the examples are Referral Marketing, Telemarketing or telesales, Online Marketing, etc. These new generation tool can be a better option when used wisely through the interested website or search engines while surfing on the internet. There are a number of companies who work as marketing companies and this can be helpful if at initial stage they are hired in a proper way and utilized.

Financial planning

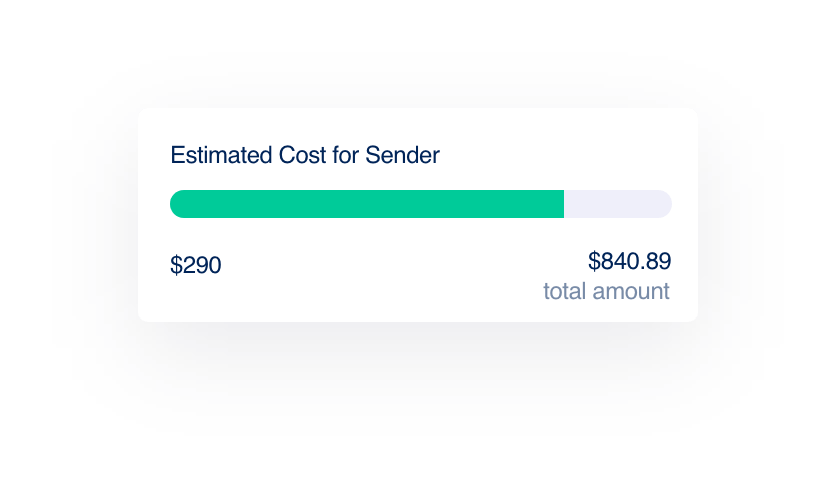

For any business plan it is essential to evaluate, analyze and scrutinize the financial planning. In simple words financial planning is nothing but step by step analysis of reaching the organization’s goals and its investments, income and expenses. Importance of Financial Planning is a key to success. To maintain the stability of the business it is essential that the Inflow and Outflow of the funds should be reasonably balanced. Financial planning helps for future growth and expansion programs of the organization. Ultimately financial planning helps the organization to maintain the stability and profitability for a long term business.

Pitch Deck Preparation

A pitch deck is a tool which gives an emphasized attention to the investor about a first informative awareness of your business in a concise manner. A well prepared pitch deck can move you a step further to your fund requirement. It supplicates the impression of your business in an extensive manner to inform the investor about your start-up project. We at Uniserve advisors use our expertise with an experienced team of financial professionals being in this segment for the last 3 decades. Some of the basic points must be included in Pitch Deck and they are like Introduction, Problem faced by the segment, Target Market, Comprehensive Solution to the problem, Traction should be used with graphs, charts, etc. Marketing and Sales Tactics, Competitors study, Financials Investment and funding and so on…

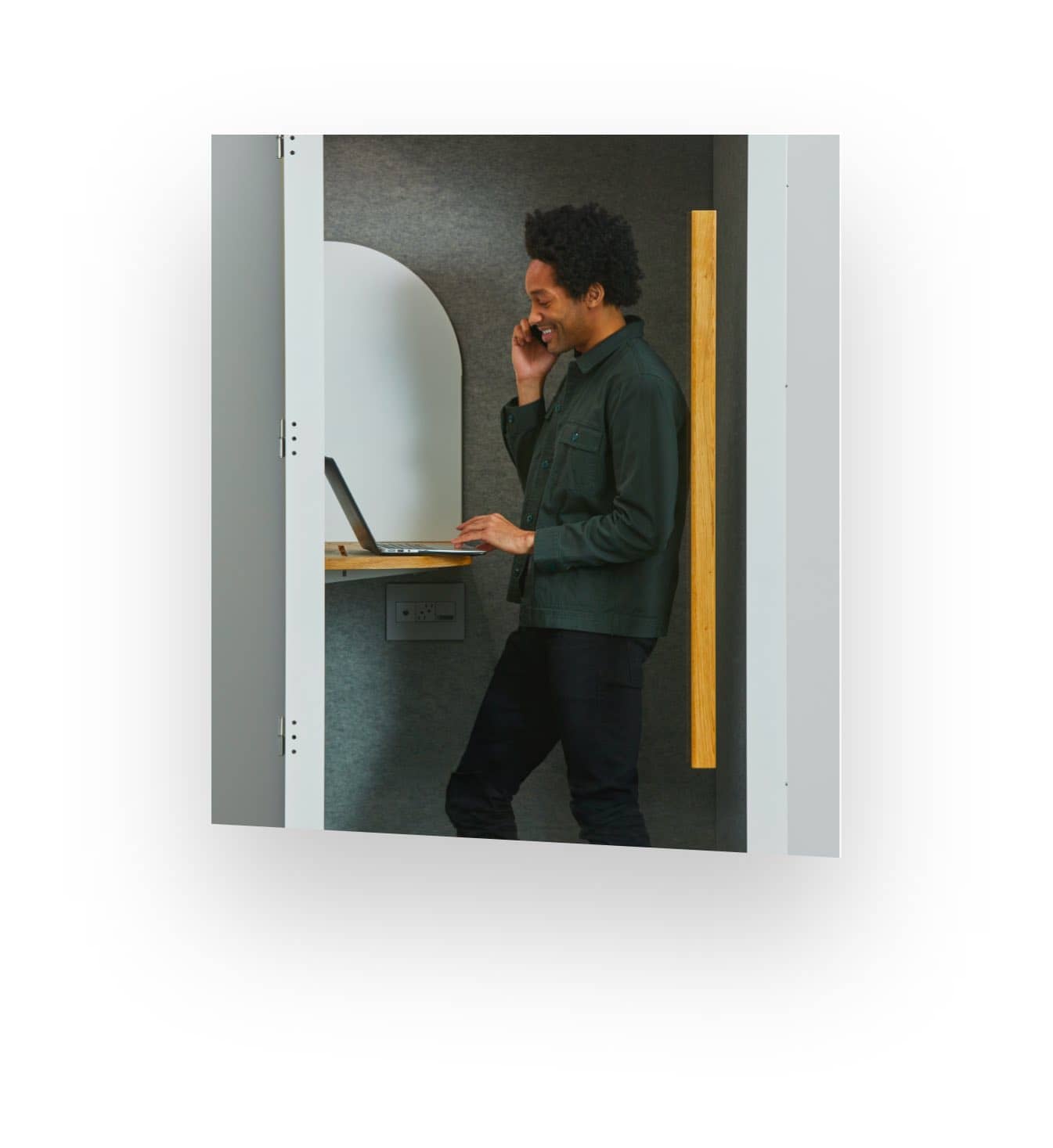

Virtual CXO

A Virtual CXO is a high scale leader who partners’ your organization’s vision and mission to function the company to drive towards growth. CXO also helps to set the standards of excellence and fix a pathway to success with his experience and tactics. In today’s era Start-ups are shifting to tier 2 and tier 3 cities of India. The discrepancy spluttered through issues like over population, real estate price hiking, unemployment, etc. These issues are secondarily encouraging the young minds of India to innovate new ideas for earning and survival. Our CXO service is boost up with early start-up projects to develop and function the working portfolio to drive sustainable growth. Our CXO will take charge of operational management which will free up the mind space of founders and co-founders to aim towards productivity of achieving the business target. Hence, at the initial stage our CXO will be taking the responsibilities of HR units, new clients, trust-building, performance management, fund movement, etc. Once the business is set up, our CXO will relieve the responsibility to the management of the company and hand over the charges to the organization.

Transaction Advisory

A third party service obtained by a professional firm or investment banking firms are known as Transaction Advisory Services. They help you in all the parameters of the firm from Start to end. They will support you in the development and growth or expansion of the business. These advisory firms are well experienced in problem solving skills and analytical decision making. Success in business is earned with hard work and dedication. The recent era is of cut throat competition and uncertain business situations. It is advisable to take an expertized professional firm’s help in critical financial or management conditions which helps to overcome or reduce the risk factors of future hurdles. A transaction advisory firm helps to fetch more deals with reducing risk factors. They have hands of experience on various industrial segments like foods, chemicals, technological sectors, electricity and power generation, etc which can be an added asset to the firm. It can be said that various parameters of business essential issues can be solved under one roof of a Business Advisory Firm.

Company Formation

A process of incorporating a business entity is known as Company Formation. Once a company is formed, a unique organization is formed with its own legal identity distinct from their owners and responsible for its own finance, asset and liability. In India all companies operating are required to register with the Registrar of Companies (RoC), a department working under the supervision of the Ministry of Corporate Affairs. In order to open a company in India, the investors will need to follow specific incorporation steps. Once they have chosen a business form suitable for their investment plans in this country such as select a trading name for the company which has to be unique at the level of the entire Indian Territory, prepare the application for registration of the business name, which should include a minimum of four proposed trading names, etc. Our organization will provide you all the service of opening any forms of company as per your requirement such as Private Limited, Partnership, LLP, etc.

Tax Consultancy and Compliance

Cash is the king of any business. Unfortunately, startup founders often fail to plan their transactions and taxes. There are a Number of ways to plan your taxes better. Incorrect planning of accounting transactions not only results in an outflow of more taxes but also results in cash accounts getting wiped out by the time tax bills come due. An ideal tax plan will pre-empt future tax provisions, strategize cash reserves so that it can be set aside to pay the taxes on time. Tax planning is necessary since it is the first line of defense against litigation claims that are related to taxes. This methodology will help you to streamline your current tax situation. This will help increase the compliance rating to the start-ups It is an obvious facts that a tax-complaint, healthy startup is always preferable to global investors. Apart from day to day benefits would be avoiding penalties, disqualification of the directors due to non-compliance, reducing cash outflows, etc. To conclude, global startups, especially those engaged in borderless internet and e-commerce transactions, outsourcing development of an intellectual property, etc. must deal with tax issues. Navigation through this labyrinth of complicated laws effectively requires that an international tax practitioner be a member of the advisory team. We endeavor to identify potential threats & opportunities and advise on appropriate strategies to mitigate exposure and optimize tax incidence on our clients. Our Tax advisory services include Compensation & Benefits, Credits & Incentives, Indirect Tax, International Tax planning, State & Local Tax, GST, etc.

Trademark & IPR

A trademark is a sign capable of distinguishing the goods or services of one enterprise from those of other enterprises. Trademarks are protected by intellectual property rights. This implies that the trademark can be exclusively used by its owner, or licensed to another party for use in return for payment. Intellectual property rights (IPR) Intellectual property rights are the rights given to persons over the creations of their minds. They usually give the creator an exclusive right over the use of his / her creation for a certain period of time. IPR provides certain exclusive rights to the inventors or creators of that property, in order to enable them to reap commercial benefits from their creative efforts or reputation. There are four types of intellectual property rights (IPR): patents, trademarks, copyrights, and trade secrets. We in our firm will facilitate all these services required by your firms to practice your business.

Legal Documentation

A Legal Documentation broadly concerns that all businesses must have contracts in place for every deal they enter into, both internally (with employees, for example) and externally (with vendors and business partners). Legal documentation plays an important role in safeguarding your business from misunderstandings and legal conflicts. Also they help to ensure accountability and transparency whenever a dispute arises in the business space. Running a fully functional business involves a bulk-load of legal documents. The list includes Agreements of buying and selling, joint venture agreement, licensing documents, Shareholder agreement, Founders agreement, Certificate of incorporation, No objection certificate (NOC), Company PAN card, TIN number, Non-disclosure agreement and so on..

ESOP Planning ( Employee Stock Ownership Plan)

In general ESOP is used by the company to encourage employees to buy shares and own a part of the company while aligning their performance and hard work. It is similar to a profit sharing plan. Employees being aware that they are shareholders and owners are bound to work with more enthusiasm and feel responsible for growth of the company. It connects the employee with emotional attachment as an owner rather than allotment of cash benefits. ESOP schemes should be prepared through a professional organization. A resolution board should be filed with the Registrar of the Companies (ROC) with the help of the company secretary. A number of legal documents such as Employment Agreement, Plan, Trust Deed, Letter of Grant Option, Letter of Acceptance by Employee, etc are required to form ESOP scheme. While implementing this scheme it incurred certain costs like administration, fees of Registered valuer, Merchant banker which has to be borne by the organization. ESOP are taxed at 2 instances in the hand of an Employee that is at the time of exercise ( as a prerequisite ) and at the time of sale by an employee ( as Capital Gain ). The process of designing and implementing your ESOP includes a number of critical steps such as Develop an Effective ESOP Plan, Choose an ESOP Financing Structure, Obtain Financing to Leverage an ESOP and Structure an Effective Transaction.

Due Diligence

In the world of startups, the term “Due Diligence” refers to an audit of a company that’s performed in order to discover possible business liabilities or deficiencies in light of a planned business transaction, such as merger or an investment. During the due diligence process, a startup management team must exhibit complete transparency, since any discrepancies discovered may jeopardize the deal. This entails being open about pending lawsuits, patents disputes, disgruntled employees, or business mistakes in hopes of establishing trust between the company and its potential investors and making the venture capital funding process smoother and faster. The process of due diligence starts once the term sheet is agreed upon between the startup and the investor. Broadly speaking there are mainly six key areas investors mostly scrutinize and they are the people, the product, the financials, the market, and equity structure and risk management. Due diligence will offer an impartial and detailed assessment of where the company is at and will give the startup a good breakdown of its strength and weakness. Types of Due Diligence are Financial due diligence, IP due diligence, Commercial due diligence, IT due diligence, HR due diligence, Regulatory due diligence and Environmental due diligence.

Company Valuation

Generally, the valuation approaches or methodologies are based on the evaluation of assets, revenue, profitability, etc. of the business. However, in the case of startups, they neither have an asset base nor revenue. Valuing a startup is an exercise of calculating the best estimate of the sum of its parts. i.e. all its resources, intellectual capital, technology, brand value and financial assets that the startup brings to the table. Stages of Funding : At the initial stage, startups are self-funded by members of the founding team who also try to secure funding through an investor or obtain a loan to help fund their venture. There are various stages when a startup raises funds and its valuation differs in each stage or round of funding. They are Angel / Seed Funding, Series A Funding, Series B Funding, Debt Funding, Mezzanine Funding, Leveraged Buyout (LBO) and Initial Public Offering ( IPO ). Considerations For Startup Valuation: Startup valuation means believing in the story and the founders’ strength to turn it into reality. It could be the sum of all the resources, technology, brand value and financial assets that the startup has developed.

Pre-Investment Preparatory Service / Fundraising Strategy

For any entrepreneur, startup fundraising is the most critical issue and 50% of the business survivals are failed due to this. There are various stages of fund raising such as Pre-seed stage, seed stage and Round A. Here Pre-seed stage is a stage where in general funds are received by friends and family members. This stage also involves pitching a startup idea to those interested in financing your idea. This stage is the examination stage to check the hypotheses of your project. It also implicates how you turn your idea into reality. Once the project is ready with the product or service you are ready to push to Angel Investor (Seed Funding). Here it goes for market testing, customer’s real problem solvency, further research, market testing, etc. Those startups which are starting a profitability ratio are given more priority for more rounds of funding. The popular seed stage investor includes Y Combinator, Tech-stars, Bain Capital Ventures and Entrepreneurs First. Later once the business gets active mobility it needs more funding where it focuses for Early stage Venture Capital, Later stage VC, fundraising through IPO and Public Market.

Branding and Marketing

A company’s brand represents its entire personality and obviously it stretches more important than its Logo. A startup business weighs more on its brand equity and for that, Branding and Marketing are an essential component for a company's development because they help to grow a business image in the market and towards its customers. It allows the company to express its core values and business methods. It helps to differentiate itself from its competitors. It articulates what it is that makes the company unique. Establishing a brand replicates a promise to the customers for longevity. Successfully marketing a new brand image in the market is one of the greatest difficulties faced by startup entrepreneurs. Thus branding & marketing helps the company to stand out of the crowd and encourages customer loyalty and foster coherence within the company’s mission itself.

Las services de sont disponibles.

Les services de paiement sont disponibles via des applications mobiles et de bureau.

Apply to raise growth capital

The Process

Smart and effective business solutions.

Initial Concept Phase

Google makes it easier to run high performance shared hosting account on its cloud platform.

Business Consultation

Google makes it easier to run high performance shared hosting account on its cloud platform.

Product Launch

Google makes it easier to run high performance shared hosting account on its cloud platform.